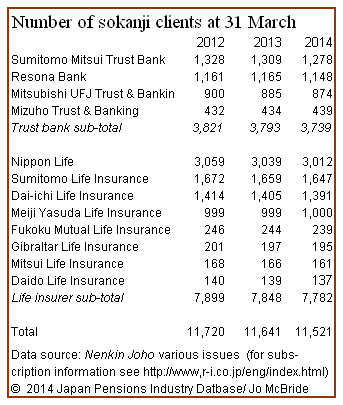

Last year Sumitomo Mitsui Trust Bank handled all the custody work, the bulk of the administration and about 75% of the asset management business of 1,278 corporate pension funds with more than 500 members each. It is unlikely ever to lose these customers but it is equally unlikely that their ranks will grow.

Resona Bank is in the same happy position with 1,148 retirement-scheme clients, as is Mitsubishi UFJ Trust & Banking with 885 and Mizuho Trust & Banking with 434.

Like life insurance companies – which service firms with smaller payrolls – the trust banks are sokanji: holders of the serei shitei hojin designation to whom companies turn when first establishing a pension fund.

Both client and service provider expect this relationship to continue in perpetuity and for the relationship to expand as additional functions, such as securities lending, develop over time.

This is the sole aspect of Japan’s corporate pensions management business never to have been deregulated and it is unlikely ever to be so. In future the pot of gold will shrink but it will take decades to disappear, making it a banking product of rare longevity.

In recent years the death rate among fragile company pension plans has been huge. In 2012 the around 70,000 so-called Tax-Qualified Plans known to the Ministry of Finance — but under little supervision — were given the option of closing, joining Serama (see previous posting), or converting to a type of defined-benefit or defined-contribution scheme supervised by the Ministry of Health & Welfare by 31 March 2013. Today a little over 13,000 former TQPs live on as DB plans.

At the same time Employee Pension Funds (EPFs), already regulated by the Ministry of Health & Welfare, were allowed to convert to a structure which no longer includes responsibility for investing firms’ contributions to the state-run Employee Pension Insurance. There are now 700+ such conversions while 500 EPFs remain as they were.

Corporate restructuring has also reduced the number of funds, though not the asset levels in the system. As companies have merged with others in the same group, or with outsiders, so have their retirement schemes.

This upheaval has come to an end without demand for sokanji services shrinking to anything like the same extent as fund numbers but very few new companies are now setting up defined-benefit plans.

As a result, the total number of clients fell from 11,720 at the year ending 31 March 2012 to 11,521 two years later, according to the latest annual survey by Nenkin Joho, a fortnightly newsletter published by an actuarial consulting subsidiary of the Nikkei newspaper.

© 2014 Japan Pensions Industry Database/Jo McBride. Reporting on, and analysis of, the secretive business of Japanese institutional investment takes commitment, money and time. This blog is one of the products of such commitment. It may nonetheless be reproduced or used as a source without charge so long as (but only so long as) the use is credited to www.ijapicap.com.

This blog would not exist without the help and humour of Diane Stormont, 1959-2012